You may be someone who looks forward to summer each year because it gives you an opportunity to rest, unwind, and enjoy more quality time with your loved ones. Now that summer is just around the corner, it’s worthwhile to start thinking about your plans and where you want to spend your vacations this year. Here are a few reasons a vacation home could be right for you.

Why You May Want To Consider a Vacation Home Today

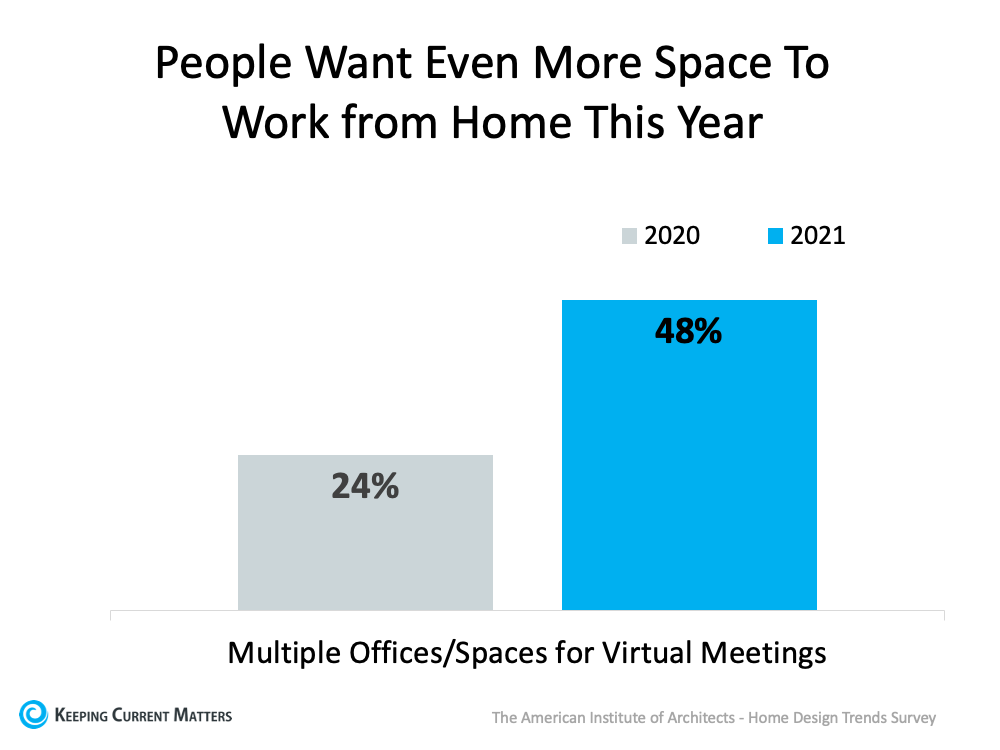

Over the past two years, a lot has changed. You may be one of many people who now work from home and have added flexibility in where you live. You may also be someone who delayed trips for personal or health reasons. If either is true for you, there could be a unique opportunity to use the flexibility that comes with remote work or the money saved while not traveling to invest in your future by buying a vacation home.

Bankrate explains why a second home, or a vacation home, may be something worth considering:

“For those who are able, buying a second home is suddenly more appealing, as remote working became the norm for many professionals during the pandemic. Why not work from the place where you like to vacation — the place where you want to live?

If you don’t work remotely, a vacation home could still be at the top of your wish list if you have a favorite getaway spot that you visit often. It beats staying in a tiny hotel room or worrying about rental rates each time you want to take a trip.”

How a Professional Can Help You Find the Right One

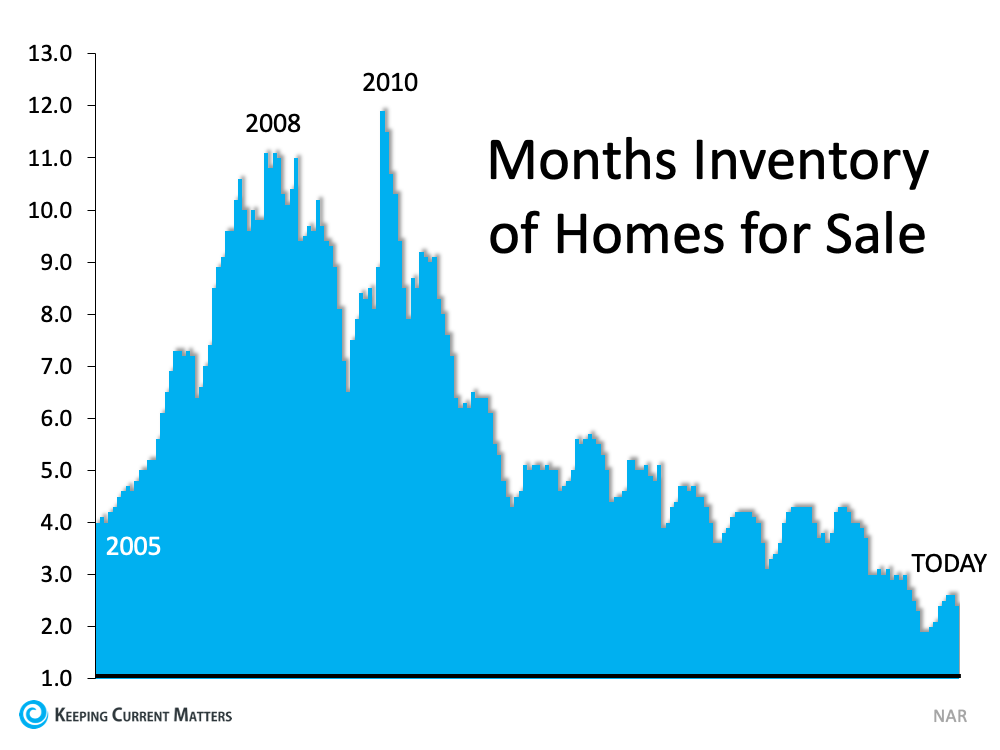

So, if you’re looking for an oasis, you may be able to make it a second home rather than just the destination for a trip. If you could see yourself soaking up the sun in a vacation home, you may want to start your search. Summer is a popular time to buy vacation homes. By beginning the process now, you could get ahead of the competition.

The first step is working with a local real estate advisor who can help you find a home in your desired location. A professional has the knowledge and resources to help you understand the market, what homes are available and at what price points, and more. They can also walk you through all the perks of owning a second home and how it can benefit you.

A recent article from the National Association of Realtors (NAR), mentions some of the top reasons buyers today are looking into purchasing a second, or a vacation, home:

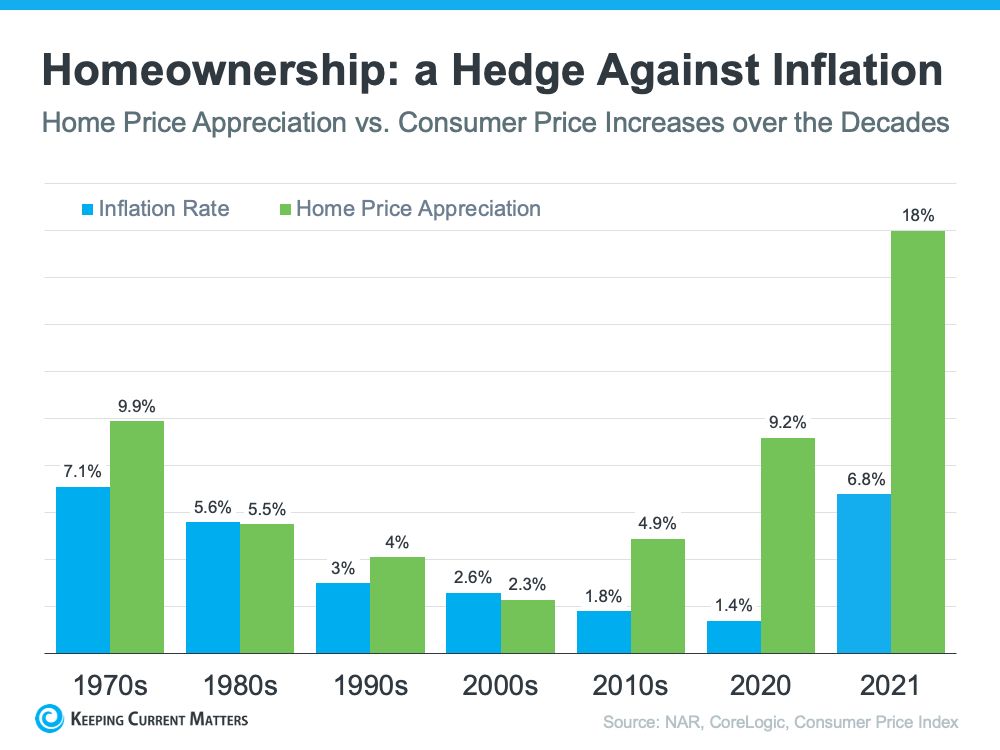

“According to Google’s data, the top reasons that homeowners cited for purchasing a second home were to diversify their investments, earn money renting, and use as a vacation home.”

If any of the reasons covered here resonate with you, connect with a real estate professional to learn more. They can give you expert advice based on what you need, your goals, and what you’re hoping to get out of your second home.

Bottom Line

Owning a vacation home is an investment in your future and your lifestyle. If this is one of your goals this year, you still have time to buy and enjoy spending the summer in your vacation home. When you’re ready to get started, reach out to a trusted real estate professional.

Keeping Current Matters | The KCM Crew 05262022