If you’re following today’s housing market, you know two of the top issues consumers face are inflation and mortgage rates. Let’s take a look at each one.

Inflation and the Housing Market

This year, inflation reached a high not seen in forty years. For the average consumer, you probably felt the pinch at the gas pump and in the grocery store. It may have even impacted your ability to save money to buy a home.

While the Federal Reserve is working hard to lower inflation, the August data shows the inflation rate was still higher than expected. This news impacted the stock market and fueled conversations about a recession. It also played a role in the Federal Reserve’s decision to raise the Federal Funds Rate last week. As Bankrate says:

“. . . the Fed has raised rates again, announcing yet another three-quarter-point hike on September 21 . . . The hikes are designed to cool an economy that has been on fire. . .”

While their actions don’t directly dictate what happens with mortgage rates, their decisions have contributed to the intentional cooldown in the housing market. A recent article from Fortune explains:

“As the Federal Reserve moved into inflation-fighting mode, financial markets quickly put upward pressure on mortgage rates. Those elevated mortgage rates . . . coupled with sky-high home prices, threw cold water onto the housing boom.”

The Impact on Rising Mortgage Rates

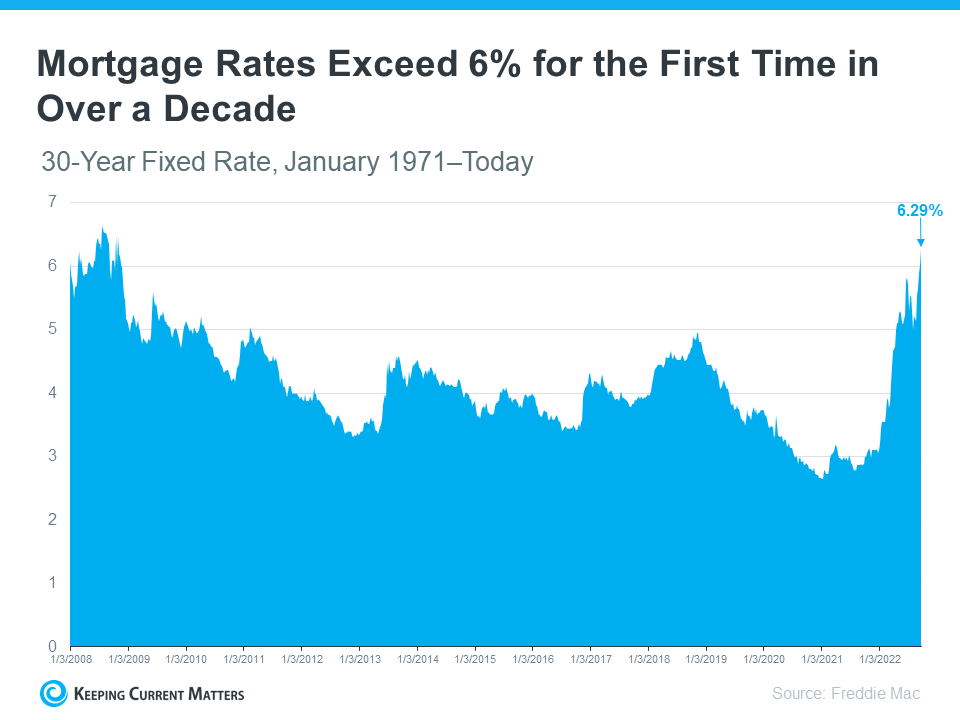

Over the past few months, mortgage rates have fluctuated in light of growing economic pressures. Most recently, the average 30-year fixed mortgage rate according to Freddie Mac ticked above 6% for the first time in well over a decade (see graph below):

The mortgage rate increases this year are the big reason buyer demand has pulled back in recent months. Basically, as rates (and home prices) rose, so did the cost of buying a home. That pushed on affordability and priced some buyers out of the market, so home sales slowed and the inventory of homes for sale grew as a result.

Where Experts Say Rates and Inflation Will Go from Here

Moving forward, both of these factors will continue to impact the housing market. A recent article from CNET puts the relationship between inflation and mortgage rates in simple terms:

“As a general rule, when inflation is low, mortgage rates tend to be lower. When inflation is high, rates tend to be higher.”

Sam Khater, Chief Economist at Freddie Mac, has this to say about where rates may go from here:

“Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, . . .”

While there’s no way to say with certainty where mortgage rates will go from here, there is something you can do to stay informed, and that’s connect with a trusted real estate advisor. They keep their pulse on what’s happening today and help you understand what the experts are projecting. They can provide you with the best advice possible.

Bottom Line

Rising inflation and higher mortgage rates have had a clear impact on housing. For expert insights on the latest trends in the housing market and what they mean for you, lean on a trusted real estate professional.

Source: Keeping Current Matters | The KCM Crew 09272022

No comments:

Post a Comment