There are many benefits to homeownership, but one of the top benefits is protecting yourself from rising rents by locking in your housing cost for the life of your mortgage.

Don’t Become Trapped

A recent article by Apartment List addressed rising rents by stating:

“Our national rent index is up 0.1 percent month-over-month, marking the sixth straight month of increasing rents. Year-over-year growth now stands at 1.2 percent.”

The article continues, explaining that:

“Rents increased month-over-month in 62 of the nation’s 100 largest cities, down significantly from the 85 cities that saw rents rise last month. That said, rents are still up year-over-year in most of the nation’s largest markets — 77 of the 100 largest cities have seen rents increase over the past twelve months.”

Additionally, Urban Land Magazine explained that,

“Currently, nearly half (47 percent) of renter households are cost burdened(i.e., paying more than 30 percent of income for housing), while 25 percent (totaling 11 million households) are severely cost burdened, paying over 50 percent of their total household income for rent.”

These households struggle to save for a rainy day and pay other bills, including groceries and healthcare.

It’s Cheaper to Buy Than Rent

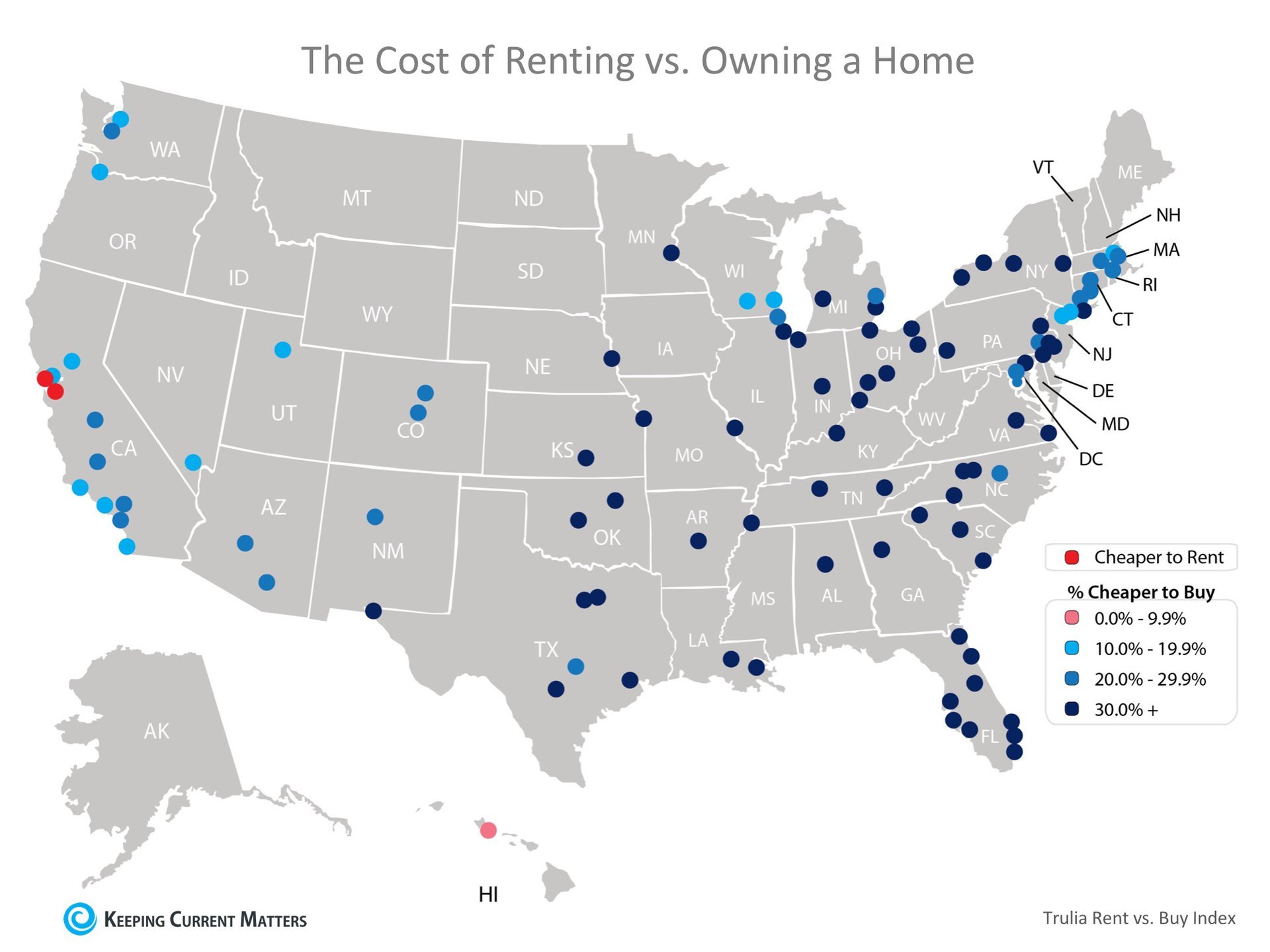

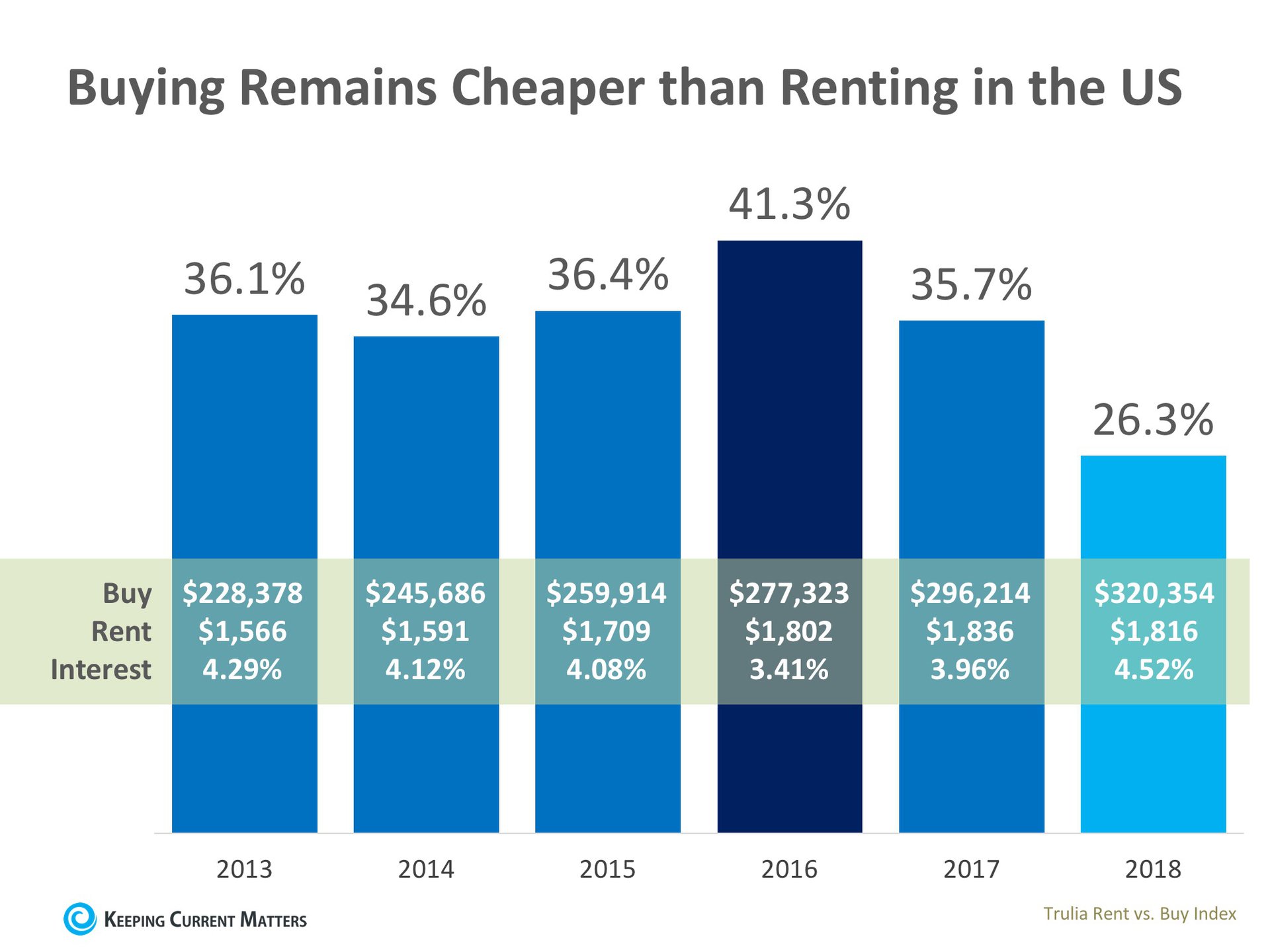

As we have previously mentioned, the results of the latest Rent vs. Buy Report from Trulia show that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

The updated numbers show that the range is an average of 2% less expensive in Honolulu (HI), all the way up to 48.9% less expensive in Detroit (MI), and 26.3% nationwide!

Know Your Options

Perhaps you have already saved enough to buy your first home. A nationwide survey of about 1,166 renters found that 34% said they rent because they cannot afford to buy, 29% said they cannot afford to buy where they live, and nearly a quarter (24%) were saving to buy.

Many first-time homebuyers who believe that they need a large down payment may be holding themselves back from their dream homes. As we have reported before, in many areas of the country, a first-time homebuyer can save for a 3% down payment in less than two years. You may have already saved enough!

Bottom Line

Don’t get caught in the trap that so many renters are currently in. If you are ready and willing to buy a home, find out if you are able. Have a professional help you determine if you are eligible for a mortgage today.

Source: Keeping Current Matters | The KCM Crew 090718