Saturday, April 17, 2021

121 MARNE ST Memphis, TN 38111

Thursday, April 8, 2021

Homeownership Is Full of Financial Benefits

A Fannie Mae survey recently revealed some of the most highly-rated benefits of homeownership, which continue to be key drivers in today’s power-packed housing market. Here are the top four financial benefits of owning a home according to consumer respondents:

- 88% – a better chance of saving for retirement

- 87% – the best investment plan

- 85% – the chance to be better off financially

- 85% – the chance to build up wealth

Additional financial advantages of homeownership included in the survey are having the best overall tax situation and being able to live within your budget.

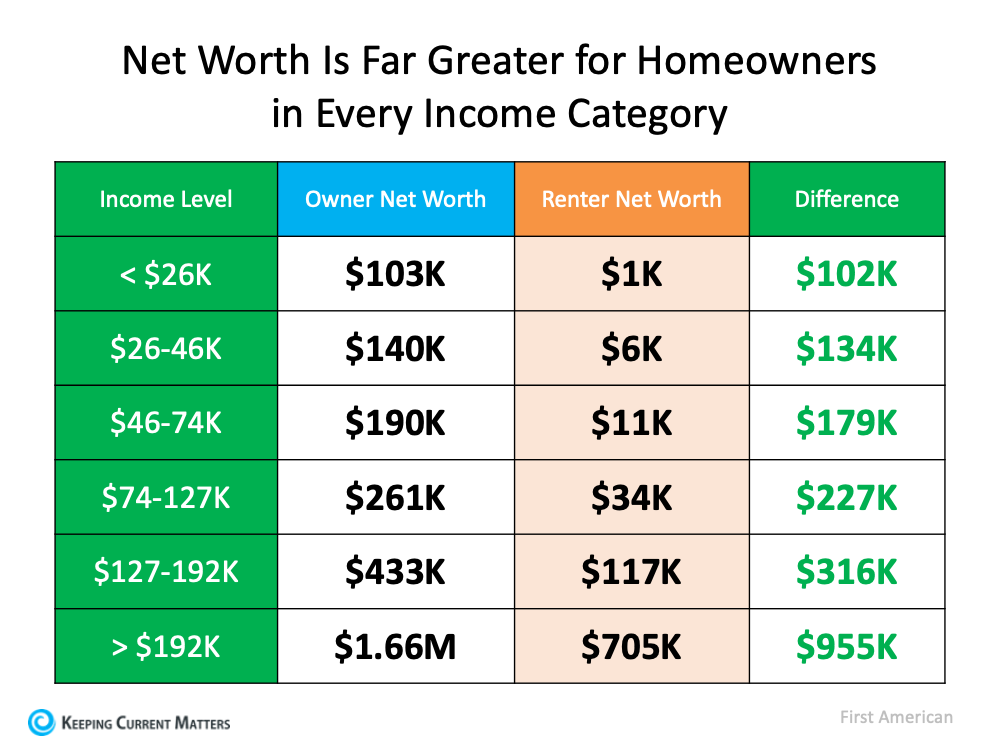

Does homeownership actually give you a better chance to build wealth?

No one can question a person’s unique feelings about the importance of homeownership. However, it’s fair to ask if the numbers justify homeownership as a financial asset.

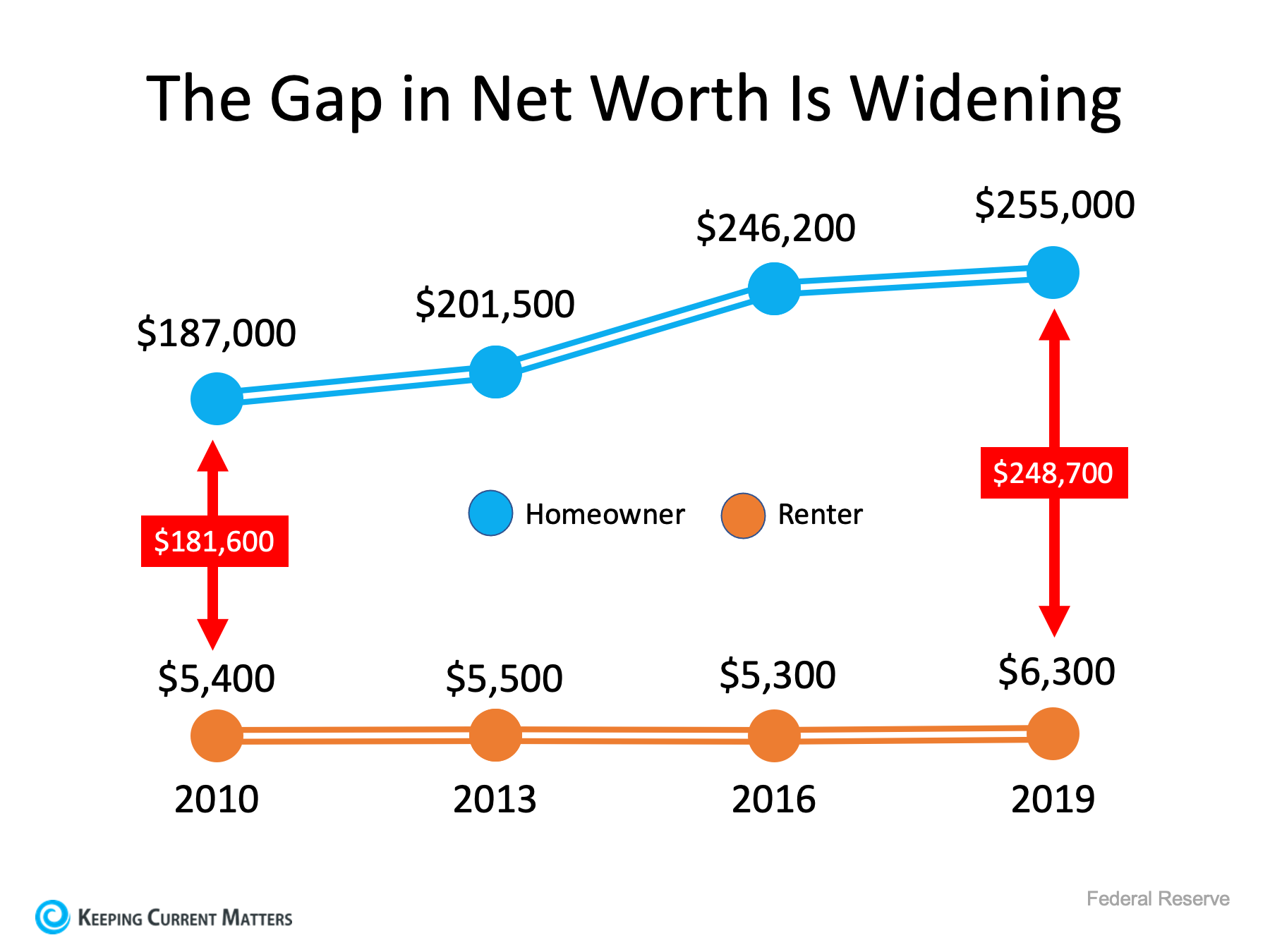

Last fall, the Federal Reserve released the Survey of Consumer Finances, a report done every three years, with the latest edition covering through 2019. Their findings confirmed that homeownership is a clear financial benefit. The survey found that homeowners have forty times higher net worth than renters ($255,000 for homeowners compared to $6,300 for renters).

“The ability to build equity puts homeowners far ahead of renters in terms of household wealth…the median owner age 65 and over had home equity of $143,500 and net wealth of $319,200. By comparison, the net wealth of the same-age renter was just $6,700.”

Homeowners 65 and older have 47.6 times greater net worth than renters.

Bottom Line

The idea of homeownership as a direct way to build your net worth has met the test of time. Contact a local real estate professional if you’re ready to take steps toward becoming a homeowner.

Keeping Current Matters | The KCM Crew 04082021

Saturday, April 3, 2021

4770 LINDA LN Memphis, TN 38117

Tuesday, March 30, 2021

How a Change in Mortgage Rate Impacts Your Homebuying Budget

Mortgage rates are on the rise this year, but they’re still incredibly low compared to the historic average. However, anytime there’s a change in the mortgage rate, it affects what you can afford to borrow when you’re buying a home. As Sam Khater, Chief Economist at Freddie Mac, shares:

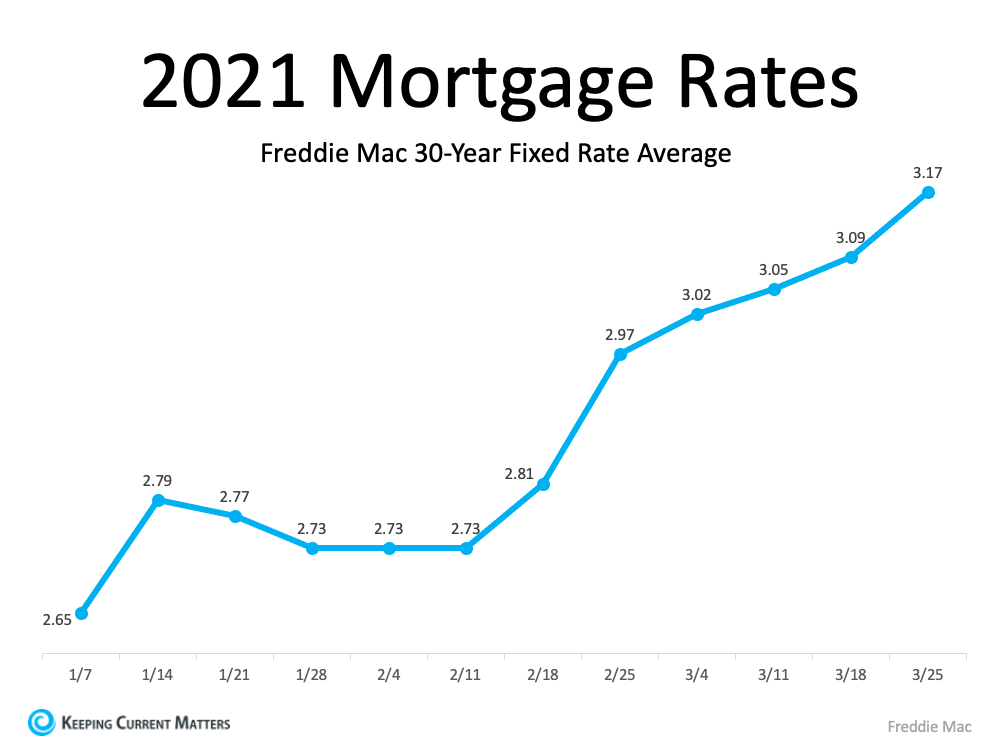

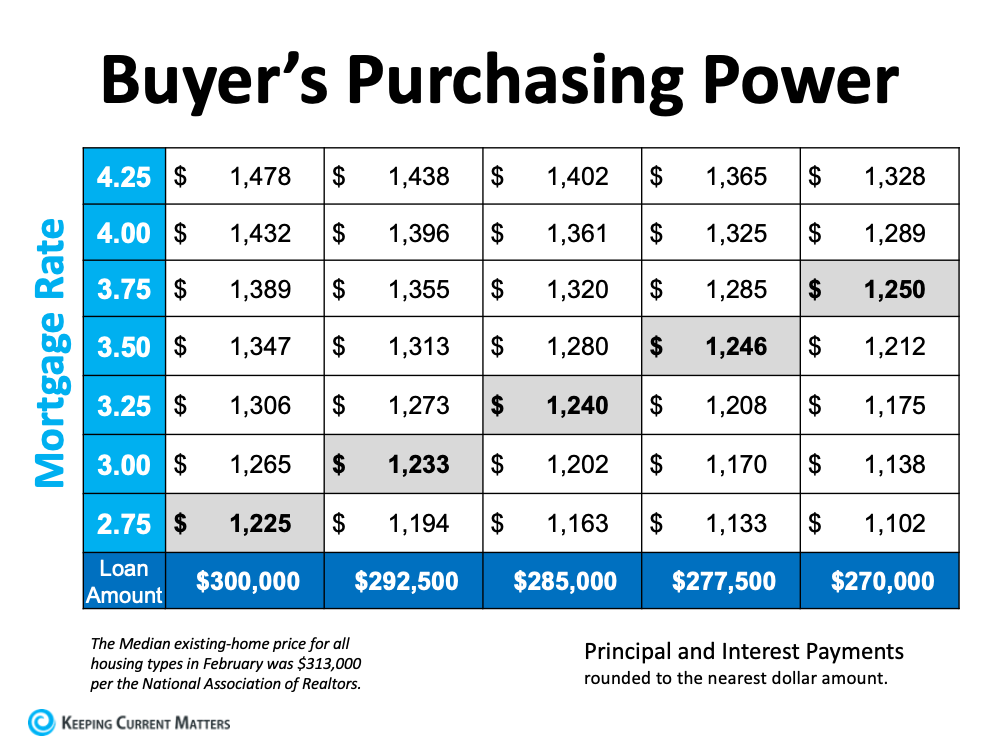

“Since January, mortgage rates have increased half a percentage point from historic lows and home prices have risen, leaving potential homebuyers with less purchasing power.” (See graph below):

In essence, it’s ideal to close on a home loan when mortgage rates are low, so you can afford to borrow more money. This gives you more purchasing power when you buy a home. Mark Fleming, Chief Economist at First American, explains:

“Monthly payments have remained manageable despite soaring home prices because of low mortgage rates. In fact, monthly payments remain below the $1,250 to $1,260 range that we saw in both fall 2018 and spring 2019, but they are on track to hit that level this spring.

Although they remain low, mortgage rates have begun to increase and are expected to rise further later in the year, thus affordability will test buyer demand in the months ahead and likely help slow the pace of price growth.”

Today’s mortgage rates are still very low, but experts project they’ll continue to rise modestly this year. As a result, every moment counts for homebuyers who want to secure the lowest mortgage rate they can in order to be able to afford the home of their dreams.

Bottom Line

Thanks to low mortgage rates, the spring housing market’s in bloom for buyers – but these favorable conditions may not last for long. Contact your local real estate professional today to start the homebuying process while your purchasing power is still holding strong.

Source: Keeping Current Matters | KCM Crew 03302021

Saturday, March 20, 2021

6582 S POPLAR WOODS CIR Germantown, TN 38138

Thursday, March 18, 2021

What Is the Strongest Tailwind to Today’s Recovering Economy?

Last year started off with a bang. Unemployment was under 4%, forecasters were giddy with their projections for the economy, and the residential housing market had the strongest January and February activity in over a decade.

Then came the announcement on March 11, 2020, from the World Health Organization declaring COVID-19 a worldwide pandemic. Two days later, the White House declared it a national emergency. Businesses and schools were forced to close, shelter-in-place mandates were enacted, and the economy came to a screeching halt. As a result, unemployment in this country skyrocketed to 14.9%.

A year later, the economy is recovering, and the U.S. has regained more than half of the jobs that were originally lost. However, some businesses are still closed, and many schools are still struggling to reopen. Despite the past and current challenges, there is one industry that’s proven to be a tailwind helping to counter all of these headwinds to our economy. That industry is housing. Remarkably, the residential real estate market (including existing homes and new construction) has flourished over the last twelve months. Sales are up, prices are appreciating, and more new homes are being built. The housing market has been a pillar of strength in an otherwise slowly recovering economy.

How does the real estate market help the economy?

At the beginning of the pandemic, the National Association of Realtors (NAR) released a report that explained:

“Real estate has been, and remains, the foundation of wealth building for the middle class and a critical link in the flow of goods, services, and income for millions of Americans. Accounting for nearly 18% of the GDP, real estate is clearly a major driver of the U.S. economy.”

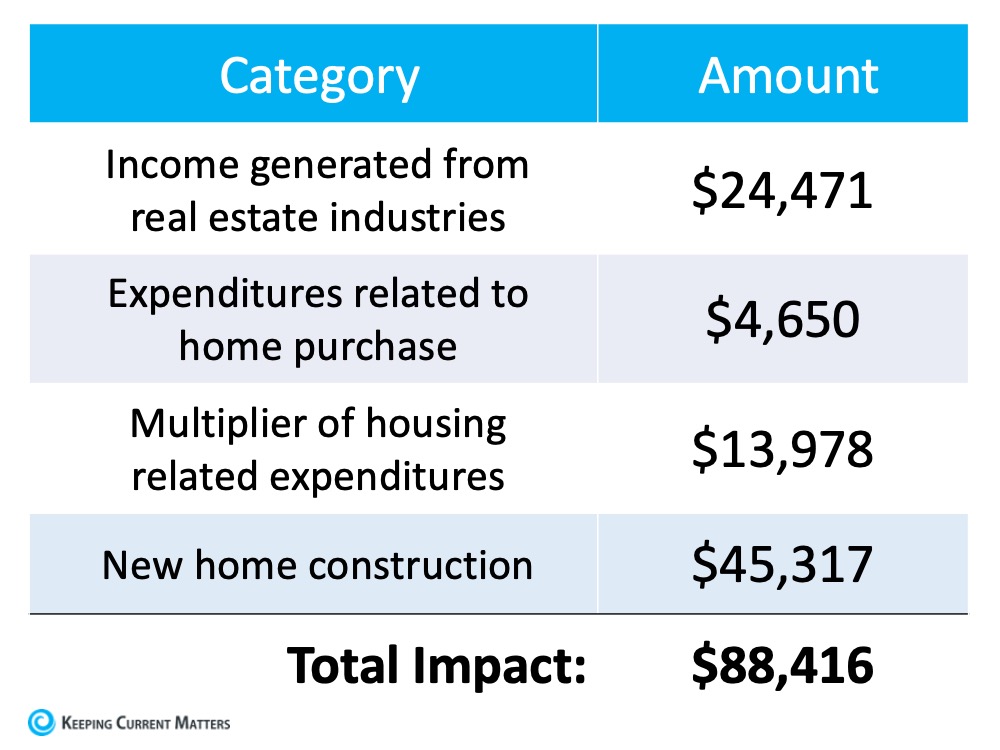

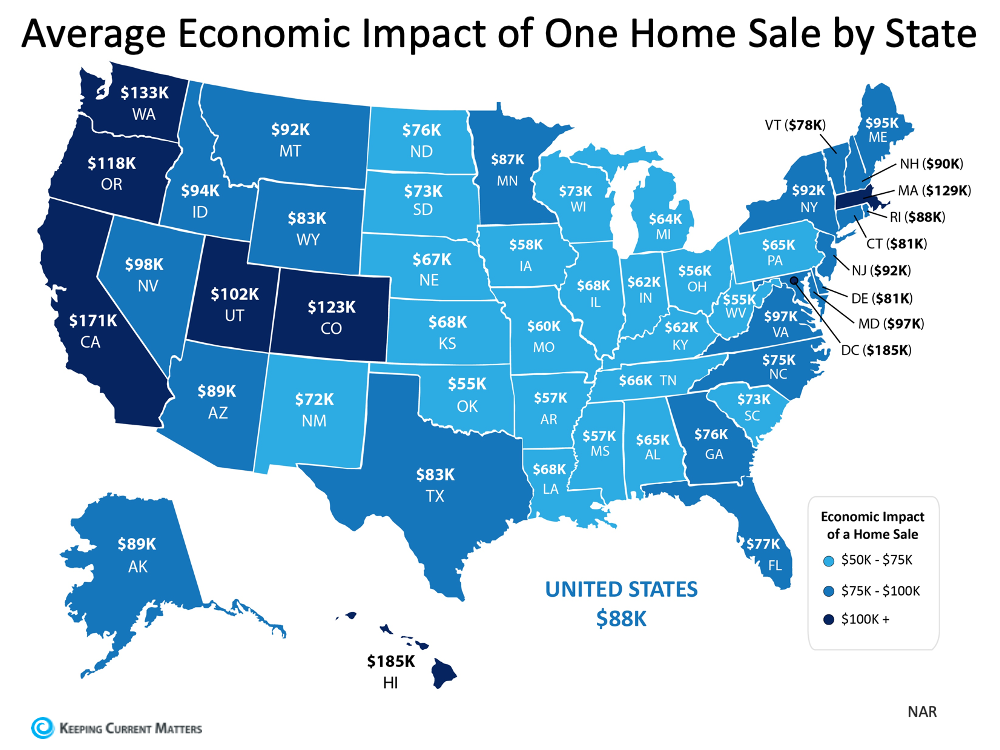

The report calculated the total economic impact of real estate-related industries on the economy as well as the expenditures that resulted from a single home sale. At a national level, their research revealed that a single newly constructed home had an economic impact of $88,416.

Real estate has done more for our economic wellbeing than virtually any other industry over the last year. It’s been a beacon of light during a very challenging time in our nation’s history.

Bottom Line

Whether you’re buying a newly constructed home or one that already exists, you’re making a positive economic impact in your local community – and it’s a step toward your homeownership goals as well.

Source: Keeping Current Matters | The KCM Crew 03202021