Spring has sprung, and it’s a great time to buy a home! Here are four reasons to consider buying today instead of waiting.

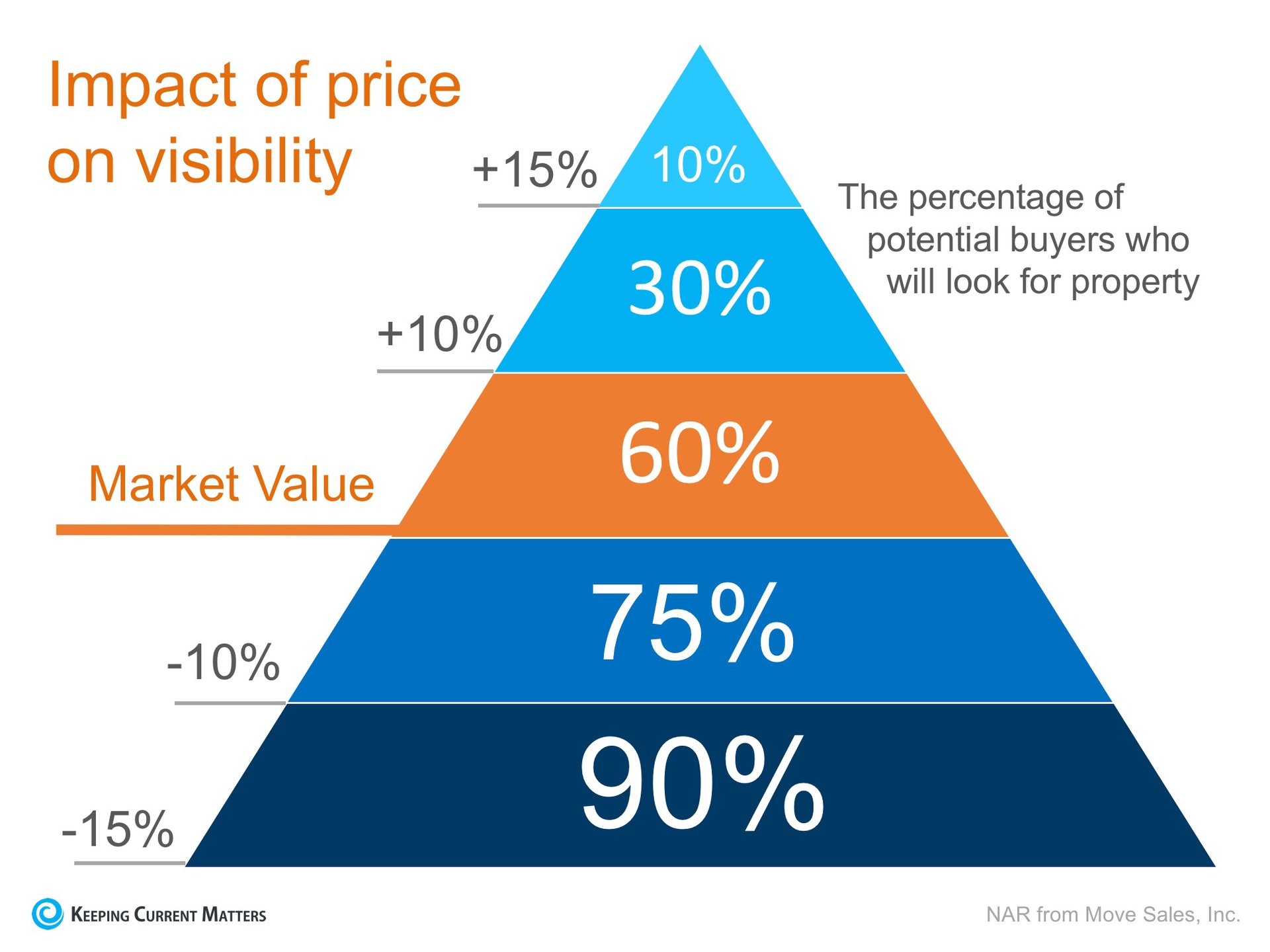

1. Prices Will Continue to Rise

CoreLogic’s latest U.S. Home Price Insights reports that home prices have appreciated by 4.4% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.6% over the next year.

Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year fixed rate mortgage came in at 4.41% last week. Most experts predict that rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac, and the National Association of Realtors are in unison, projecting rates will increase by this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You Are Paying a Mortgage

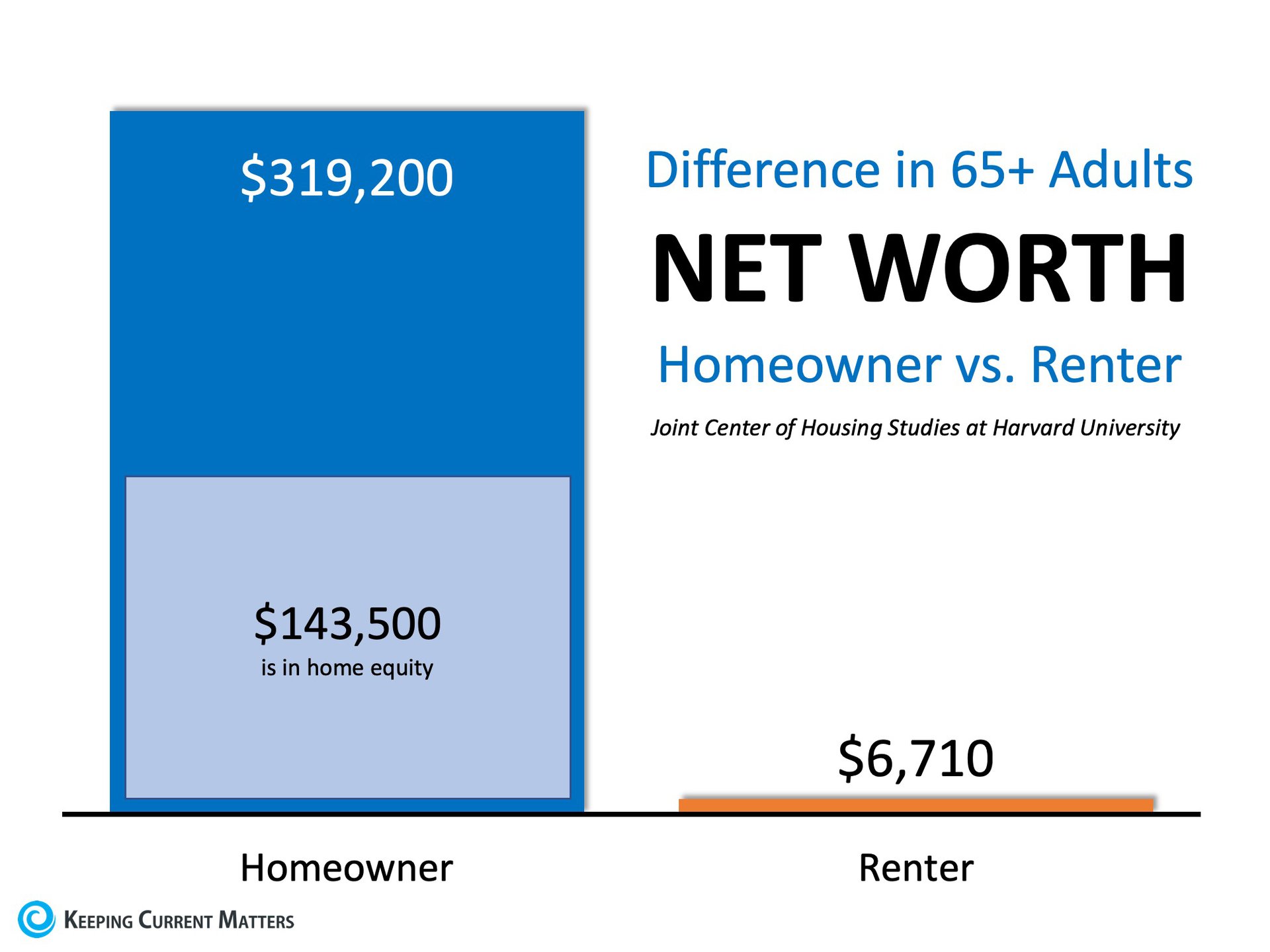

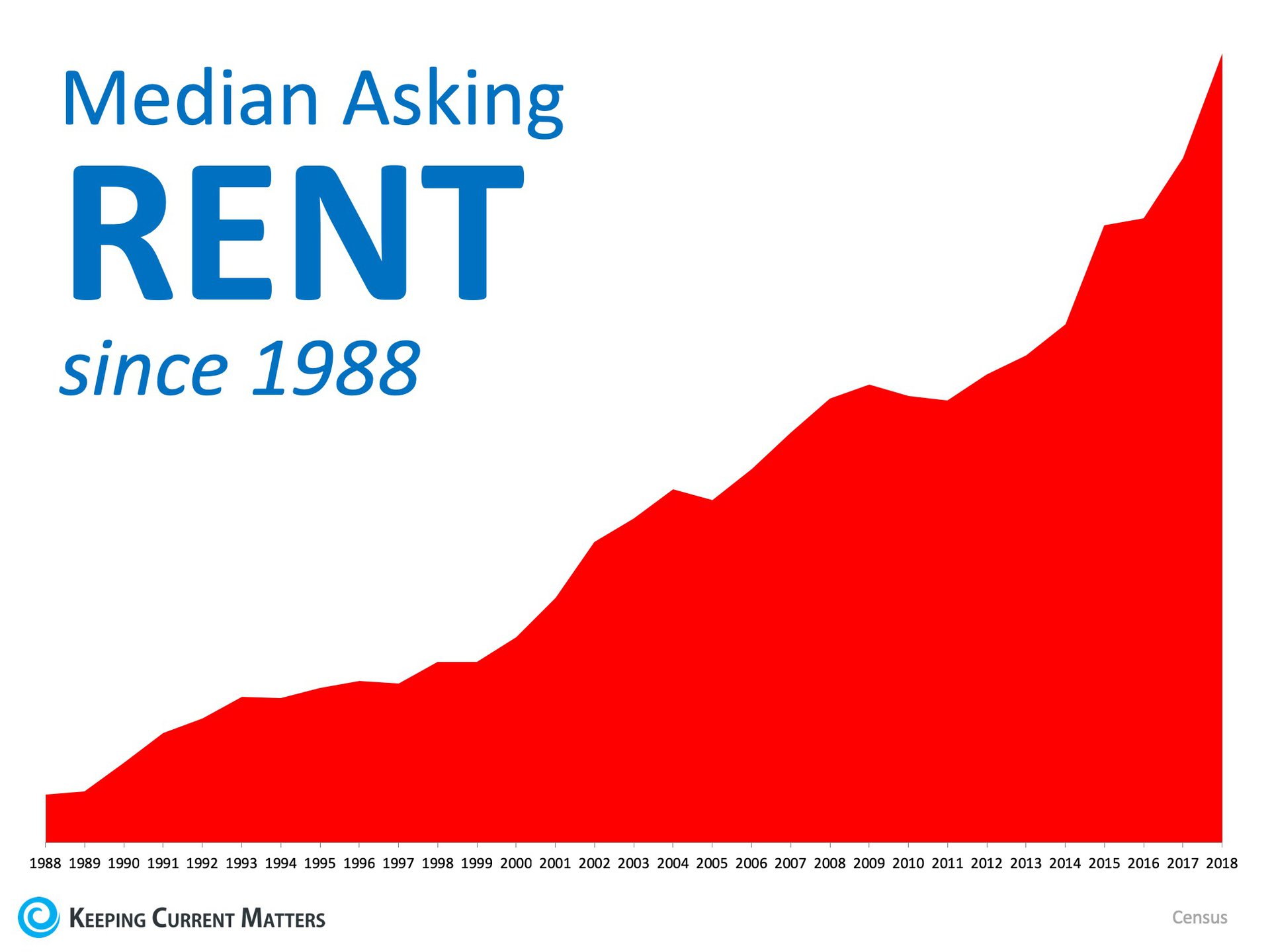

Some renters have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move On with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Examine the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, greater safety for your family, or you just want to have control over renovations, now could be the time to buy.

Bottom Line

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Source: Keeping Current Matters | The KCM Crew 031219