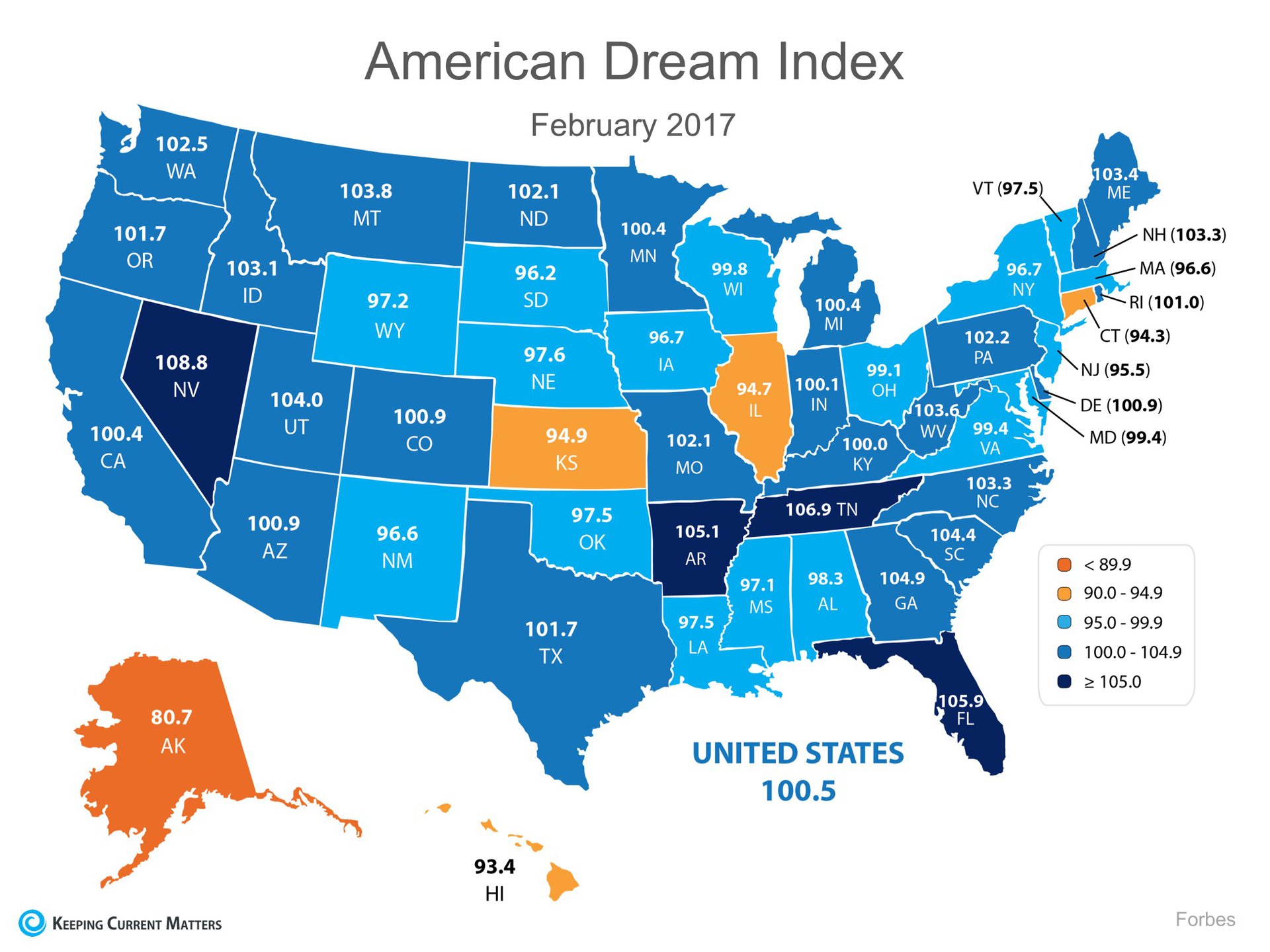

Forbes.com recently released the results of their new American Dream Index, in which they measure “the prosperity of the middle class, and…examine which states best support the American Dream.”

The monthly index measures several different economic factors, including goods-producing employment, personal and commercial bankruptcies, building permits, startup activity, unemployment insurance claims, labor force participation, and layoffs.

The national index score was rounded out to 100 in January and saw a modest jump to 100.5 in February.

Alaska represented the lowest score on the index at 80.7, due mostly to the recent collapse in oil prices. Nevada came in with the highest score at 108.8, boosted by big gains in goods-producing jobs and new construction activity. The full results can be seen in the map below.

Forbes Senior Editor Kurt Badenhausen explained why many states saw a boost in the index last month:

“[B]usinesses are hiring in part in anticipation of tax cuts and less regulation... Many areas of the country have experienced strong upticks in employment and construction, as well as declines in unemployment claims since the start of the year.”

Bottom Line

The American Dream, for many, includes being able to own a home of his or her own. With the economy improving in many areas of the country, that dream can finally become a reality.

Source: Keeping Current Matters | KCM Crew 04192017