The inventory of existing homes for sale in today’s market was recently reported to be at a 3.6-month supply according to the

National Association of Realtors latest Existing Home Sales Report. Inventory is now 7.1% lower than this time last year, marking the 20

th consecutive month of year-over-year drops.

Historically, inventory must reach a 6-month supply for a normal market where home prices appreciate with inflation. Anything less than a 6-month supply is a sellers’ market, where the demand for houses outpaces supply and prices go up.

As you can see from the chart below, the United States has been in a sellers’ market since August 2012, but last month’s numbers reached a new low.

Recently

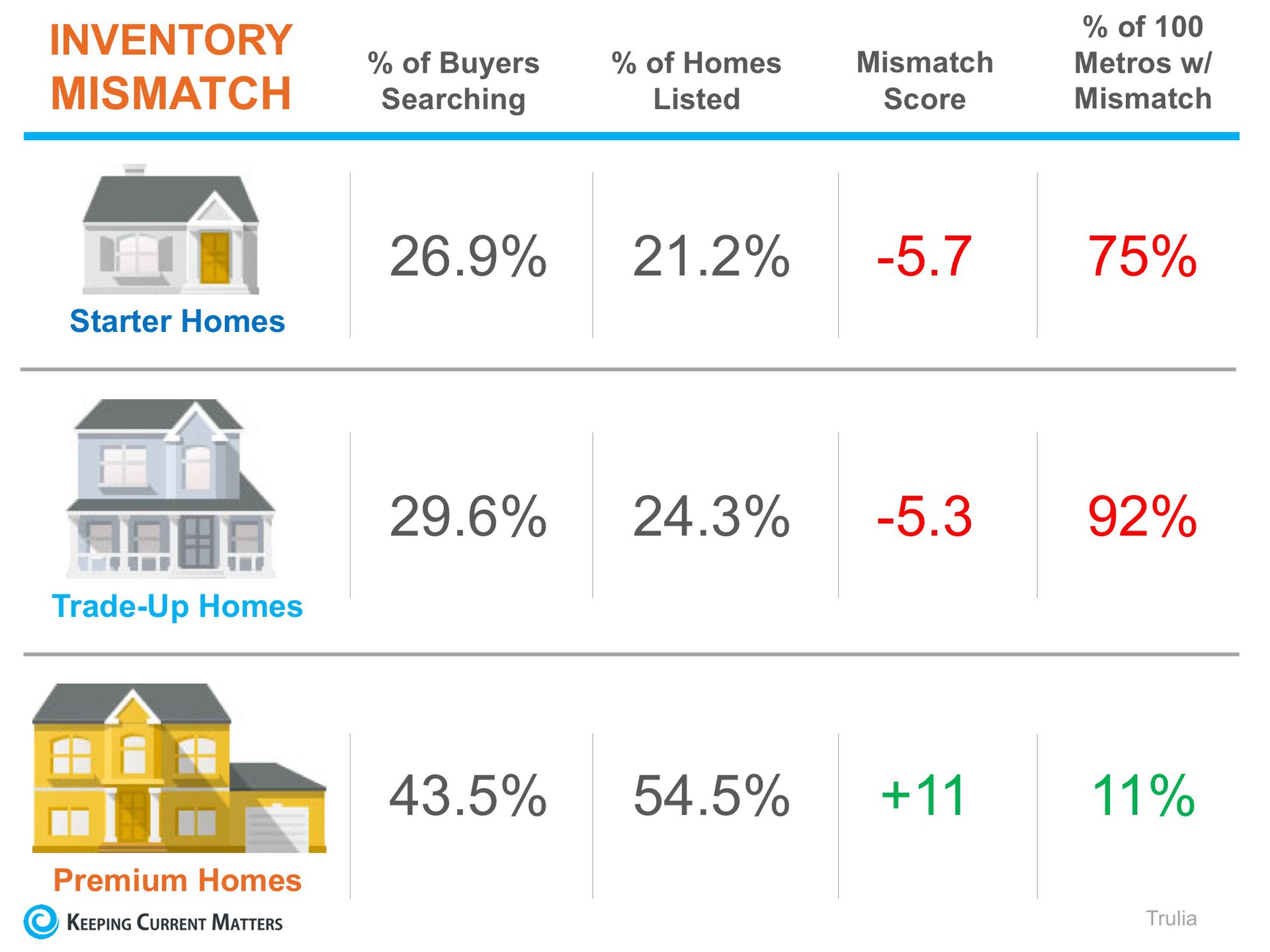

Trulia revealed that not only is there a shortage of homes on the market in general, but the homes that are available for sale are not meeting the needs of the buyers that are searching.

Homes are generally bucketed into three groups by price range: starter, trade-up, and premium.

Trulia’s market mismatch score measures the search interest of buyers against the category of homes that are available on the market. For example: “if 60% of buyers are searching for starter homes but only 40% of listings are starter homes, [the] market mismatch score for starter homes would be 20.”

The results of their latest analysis are detailed in the chart below.

Nationally, buyers are searching for starter and trade-up homes and are coming up short with the listings available, leading to a highly competitive seller’s market in these categories. Ninety-two of the top 100 metros have a shortage in trade-up inventory.

Premium homebuyers have the best chance of less competition and a surplus of listings in their price range with an 11-point surplus, leading to more of a buyer’s market.

“It leaves Americans who are in the market for a home increasingly chasing too fewer options in lower price ranges, and sellers of premium homes more likely to be left waiting longer for a buyer.”

Lawrence Yun, NAR’s Chief Economist doesn’t see an end to this coming any time soon:

“Competition is likely to heat up even more heading into the spring for house hunters looking for homes in the lower- and mid-market price range.”

Bottom Line

Real estate is local. If you are thinking about buying OR selling this spring, sit with a local real estate professional who can share with you the exact market conditions in your area.

SOURCE: Keeping Current Matters | KCM Crew 031517

![Spring Forward: The Difference An Hour Makes [INFOGRAPHIC] | Keeping Current Matters](http://d3sj2vq3d2xms.cloudfront.net/wp-content/uploads/2017/03/07154721/The-Difference-a-Hour-Makes-KCM.jpg)